Understanding Common Exclusions in Home Warranty Contracts

Home warranty contracts can look reassuring, but the exclusions hidden in the fine print often determine how useful the coverage will be when something breaks. Knowing what is not included, where limits apply, and how to read these clauses carefully helps homeowners avoid unpleasant surprises and plan realistic protection for their property.

Understanding Common Exclusions in Home Warranty Contracts

Many property owners assume that once they sign a home warranty agreement, every system and appliance in the house is automatically protected. In reality, the value of a plan depends heavily on its exclusions, limitations, and conditions. These details decide whether a claim is approved, partially covered, or denied entirely. Understanding common carve outs can help you compare plans more carefully and use your coverage more effectively.

What is typically not covered by home warranties?

Most home warranty plans focus on normal wear and tear for specified systems and appliances, not every possible problem that might occur. Items that are not explicitly listed on the contract are usually excluded by default. For example, many plans omit secondary refrigerators, outdoor kitchens, or specialty appliances such as wine coolers and commercial grade stoves.

Cosmetic issues are also commonly left out. Scratches on a cooktop, noise from an aging dishwasher, or faded finishes on fixtures might be frustrating, but they are rarely covered events. Structural parts of the home, such as walls, foundations, roofs, windows, and doors, are typically outside the scope of a standard home warranty and fall under other types of property protection instead.

Critical items often excluded from home warranty plans

Certain categories come up again and again in exclusion lists, even when the related system is generally covered. Pre existing conditions are a prime example. If a system or appliance showed signs of failure or was not working correctly before the contract start date, the provider may treat it as excluded.

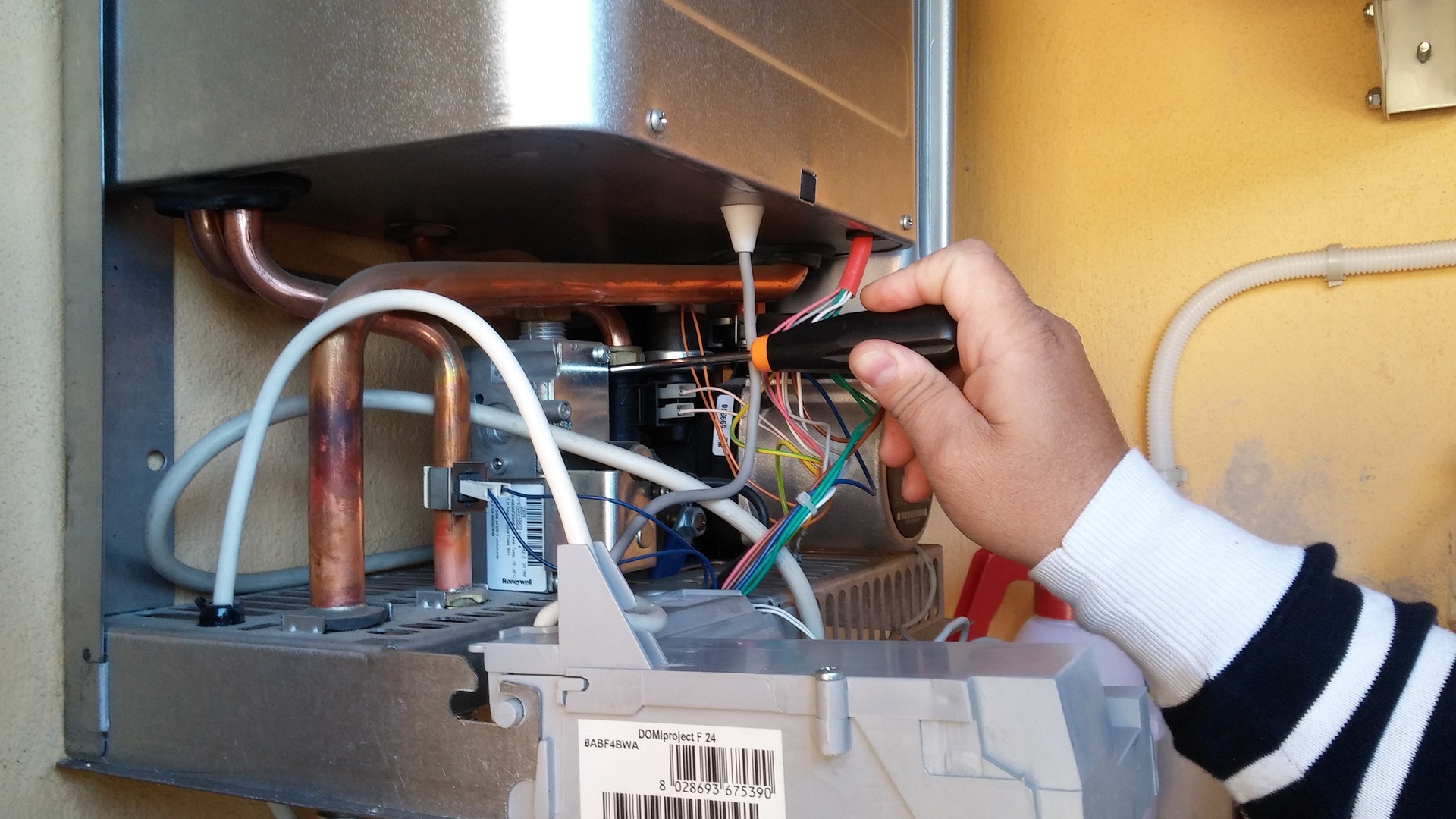

Improper installation or modification is another major exclusion. If an air conditioner was installed without following manufacturer guidelines or local codes, the warranty company can deny related claims. Similar rules apply to insufficient maintenance. When filters are not replaced, vents are blocked, or recommended tune ups are skipped, failures linked to that neglect may be considered outside the plan.

Exploring the fine print of home warranty exclusions

The fine print around exclusions can be just as important as the obvious lists of what is and is not covered. Many contracts exclude specific parts of otherwise covered systems. A plan might include a water heater but exclude the tank if it leaks due to corrosion beyond a certain age, or it might cover a plumbing line but exclude access costs if the pipe is buried in concrete.

Other exclusions are tied to events, not items. Damage from natural disasters, flooding, fire, or theft is often classified as an insurance matter rather than a warranty claim. Problems caused by pests, mold, or hazardous materials are also frequently excluded. Because these situations overlap with other types of property protection, it is important to understand where responsibilities begin and end across all of your agreements.

Key considerations for home warranty coverage limits

Even when something is technically covered, coverage limits can restrict how much support you receive. Many plans set a maximum payout per item, per trade, or per contract term. Once that limit is reached, any additional repair or replacement cost usually falls to the homeowner.

Age and condition limits also matter. Some companies provide reduced coverage or replacement with similar used equipment when a system or appliance is older. Others cap coverage for high value components such as heating and cooling systems, pool equipment, or built in appliances. Reading how these limits apply in different categories helps you understand the realistic financial support a plan may provide.

Service call fees and repeated claims can indirectly shape the value of coverage as well. If the cost for each visit from a technician is high, or if frequent small repairs are needed, the total out of pocket spending may be more than you expect. While these fees are not always labeled as exclusions, they influence how much practical protection you receive.

How to navigate home warranty agreement exclusions

Navigating exclusions begins with carefully reading the sample contract before you enroll, not only the marketing summary. Look for detailed sections titled exclusions, limitations, and conditions, and compare them across plans. Pay attention to how pre existing conditions are defined, what documentation is required, and whether a home inspection is recommended before coverage begins.

It is also useful to match the contract language against the actual systems and appliances in your home. Note the age, brand, and condition of major items, and check whether specialty features or upgrades are mentioned. If you rely on equipment such as well pumps, septic systems, or pool components, confirm whether they are included or listed as optional add ons that require extra fees.

If any wording seems unclear or broad, consider asking the provider for written clarification. Keeping records of questions, answers, maintenance receipts, and service reports can help support future claims. Because rules and regulations differ between regions and providers, homeowners in different parts of the world should also consider local consumer protection laws or regulatory guidance when evaluating how exclusions are handled.

Bringing it all together

Understanding common exclusions in home warranty contracts is a key part of evaluating whether a plan fits your needs. By looking past marketing summaries and focusing on what is not covered, where limits apply, and how conditions affect eligibility, you can form a more realistic picture of potential benefits. Clear knowledge of exclusions helps you combine warranty coverage with other forms of property protection and maintenance planning, reducing surprises when systems or appliances eventually need repair or replacement.